How to Build Wealth in 17 Surprisingly Simple Ways

Master Your Money

Optimize Your Investments

Does this list of worries sound familiar: You are busy as hell. Your kids are growing up fast. College is no longer in the distant future. Job is crazy. Those once restful weekends are now a thing of the past.

And, to top it all off, you have a nagging worry: You are not sure how to build wealth most effectively.

Wouldn't it be great if someone created a simple guide that tells you how to build wealth, including actionable advice and easy-to-use apps?

Well, guess what - that's exactly what I did.

1. Track Your Spending

It’s important to know where and how you spend your money. Set up a system to track your spending and make it part of your financial habit.

*Quick Tips

Simply being aware of what you spend has a powerful effect on how you spend.

Tracking your spending can uncover simple ways to easily “trim some fat” and boost your savings.

It used to be a real pain to do this, but today’s user-friendly apps and connected bank accounts makes this a snap.

*Useful Apps / Resources

Our favorite app for tracking your spending is You Need a Budget (YNAB for short). It’s great software, but the real value is from support & education you get when you buy the software, such as free online classes.

Mint is the granddaddy of personal finance apps. Connect up your accounts and the system will automatically download your transactions into the platform.

Finally, a good old-fashioned spreadsheet can also be a useful way to track your spending. It’s the most manual process, but it’s the most customizable. Google Sheets or Excel are the top choices here.

2. Create a Budget

Budgets help you stay on track. In the past, sticking with a budget was more difficult because you didn’t see your budget often, and it wasn’t easy to access at a glance. But today’s budgeting apps live on your computer, the cloud and--most importantly--your smartphone. This makes it much easier to check and keep tabs on your budget.

*Quick Tips

Traditional budgets don't work.

Today’s budgeting apps live on your computer, the cloud and--most importantly--your smartphone. This makes it much easier to check and keep tabs on your budget.

*Useful Apps / Resources

You Need a Budget (YNAB) is top on the list. Their core mission is to “help you stop living paycheck to paycheck, get out of debt, and save more money faster!”

HomeBudget with Sync has great design and flow.

The tried-and-true spreadsheet approach works here too. Google Sheets is a good option because it's simple to use and easy to share it with your spouse. (Nothing enhances passion with your spouse like a well designed spreadsheet).

3. Know Your Net Worth

Do you really want to reach your financial goals? Then you need to know where you stand. Today. That’s why a Net Worth snapshot is valuable.

*Quick Tips

Think of your Net Worth as a snapshot in time of exactly everything you own minus everyone you owe (Assets - Liabilities = Net Worth).

It’s a good idea to create a Net Worth snapshot at least every year and archive it. That way you can quickly see if you are making progress towards your goals.

*Useful Apps / Resources

One of the most powerful, yet easy to use ways we know for keeping tabs on your net worth is our online portal (the same tool we use for our clients). Our secure system gives you a total snapshot of your net worth and investments. The platform keeps your total net worth updated daily and is available anytime. Interested to see it in action? We can give you a free demo.

4. Automate Your Savings

I love this one; it's so easy and incredibly powerful. The main idea is to set up scheduled, automatic deposits from you bank into separate accounts. Why does this work? Well, it’s simple. Have money, will spend. More money? More spending. Less money? Less spending. We all know the deal. It’s human nature, and this little “trick” really puts us on track to automatically meet our goals.

*Quick Tips

Set up scheduled, automatic deposits from your bank account into separate savings / investment accounts.

Each account is earmarked for specific goals: Emergency fund, Retirement, College Savings, etc.

Supercharge your savings by direct depositing money from your paycheck into your savings accounts. Call your HR dept. to set it up.

*Useful Apps / Resources

Ally Bank is a great place to set up all your savings accounts (as many as you like). Great rates too: 1.00% on their Online Savings account.

There’s an entire book on the power of automatic investing called “The Automatic Millionaire” by David Bach. It’s a good, quick read.

Digit is a handy app that lets you "save money without thinking about it." Qapital is another excellent choice that helps you save for the stuff you want. Both are free and have well-designed, simple interfaces to help you save money and build wealth.

5. Create an Emergency Fund

Has anything unexpected and bad happened to you in your life? Now that you have a family to support and the stakes are higher, it's important to have a "cash cushion" for when life throws you that inevitable curveball.

*Quick Tips

Put 6 months of living expenses in a safe, easy-to-access account

Do not treat this as an investment and invest it in "safe" dividend paying stocks, bonds, etc.

Few people think they will need this, until they do. I've had 2 clients with "out of the blue" events that required emergency funds.

*Useful Apps / Resources

Once again, Ally Bank is a great option for an emergency fund account.

For convenience, you can also use your current bank. Simply open up a separate savings account for just this purpose.

6. Reduce Your Debt

As financial author Dave Ramsey has said: "Debt is normal. Be weird." That pretty much sums up our thinking on debt.

*Quick Tips

Get a handle on what you owe. Collect all the information on all the debts you have, such as type, amount you owe, rate, minimum payments, etc.

Set up automatic payments for your debt. Similar to automating your savings, do the same for your debt payments.

Free up more cash. Now that you are tracking your spending, see if you can find ways to cut back a bit and put that extra cash towards your debt.

*Useful Apps / Resources

Try the "Debt Snowball" method for paying off your debt. This is the approach I use for some of my clients and it works well.

7. Review Your Insurance

As soon as you have a family that depends on you financially, you need insurance. Most of us don't like to think about insurance. It's complicated. It's emotional. It makes you think about scenarios that make you cringe. But it could happen. Be prepared.

*Quick Tips

Review "The big 4" types of insurance: Life Insurance, Health Insurance, Disability Insurance, Liability Insurance

Life insurance is protection, not an investment. Avoid "Whole Life Insurance," which is complex, expensive, and illiquid (hard to sell).

Stick with Term Life Insurance, which is pure insurance (no investing component).

*Useful Apps / Resources

For life insurance quotes, these are good websites: Term4Sale and Insure.com.

If you'd like a more personal touch, work with an insurance agent. You can find one with this Google search: “independent insurance agent” + your state

If you need independent health insurance ehealthinsurance.com is a good website.

8. Create or Update Your Estate Plan

Estate planning is not just for the ultra-wealthy. It's also not as expensive as you might think. Yes, it means thinking about some unpleasant scenarios. But if you don't think about this now, it can be a real mess for someone else to figure out, including what happens to your kids.

*Quick Tips

Core components of an estate plan: Will, Durable Financial Power of Attorney, Healthcare Proxy, and a Trust. If you have kids, we'd highly recommend creating a Trust.

Make sure you beneficiaries are up to date: Bank accounts, brokerage accounts, retirement accounts, life insurance policies, etc. should all have correct, up-to-date beneficiaries.

Estate plans are typically a one time fee in the neighborhood of about $1,000 to $3,000, depending on complexity.

*Useful Apps / Resources

Although there are online resources out there for parts of an estate plan, this is one place we'd recommend in-person legal counsel.

Ok, now that you have Mastered Your Money, let's move on to Optimize Your Investments.

9. Know Your Personal Risk Level

Risk is a very complicated subject. Risk is doubly complicated when we throw money into the equation. People react in very unusual and counterintuitive ways when they start to lose money. Moreover, most people under-estimate how much risk they can handle when it comes to investments. It can lead to bad situations, including sleepless nights and panic selling during market downturns.

*Quick Tips

Determine your own Personal Investment Risk here

Money and investing can stir up powerful emotions, especially during times of market exuberance and the inevitable crashes.

Be sure you know some of the common behavioral pitfalls that trip up investors and how to spot them: Herd Mentality, Sunk Costs, and more.

*Useful Apps / Resources

10. Create an Investment Strategy

You can't beat the market. And it's damn near impossible to find the professionals who can beat the market before they get famous (it's easy to find them in hindsight!). So, why not use the best academic evidence to create an investment strategy? That's smart investing.

*Quick Tips

We are big fans of "Evidence-Based" investing. Put simply, this means we use the best academic research to guide our investment strategy.

Avoid "Actively Managed" funds (a single manager or team picks stocks to try to bear the market). Here is why: The Weight of Evidence

A sound investment strategy built on decades of academic evidence helps you stay the course during market turmoil.

*Useful Apps / Resources

Dimensional Fund Advisors and Vanguard are top choices to implement an Evidence-Based investment strategy.

Most of the experts in our "Expert Tips on Building Wealth for Forty Somethings" post follow an Evidence-Based investment strategy.

11. Organize Your Investments

Investments, assets, liabilities and insurance. Know all about yours? If your spouse said “Honey, what is the total of all our investments” can you answer that? Easily? Or during the recent market setback, did you wonder how all your investments performed?

*Quick Tips

It's much easier to keep tabs on all your money and investments when it's in one, easy-to-access location, updated daily.

It's a good idea to keep everything--even loans, debt, and mortgages--in one location so you always see where you stand financially.

Switched employers? Rollover old 401k accounts into IRA accounts for consolidation and easier monitoring.

Here are some blog posts were wrote on staying organized: Time for a Spring Cleaning and Assembling a Diversified Portfolio.

*Useful Apps / Resources

What about a secure, online portal where you can see ALL your investments in one place. An online platform that is updated daily and accessible 24/7. You can even see your home value, mortgage, credit card balances and even life insurance--your whole net worth. That’s our online portal. Interested to see it in action? We can give you a free demo.

12. Lower Your Investment Fees

Many people use mutual funds and ETFs to invest (either on their own or through their 401k at work). Every mutual fund and ETF has what is called an expense ratio. Think of this as a price tag for investing. Be sure you know exactly how much you pay for each of your investments. It's not hard to find out the expense ratio when you know where to look.

*Quick Tips

Fees matter. Choose low cost funds.

Every mutual fund and ETF has what is called an expense ratio. Think of this as a price tag for investing. Expense ratios are often buried and overlooked (and are devilishly creative in the way they are covertly paid), and they cost real money for investors.

Actively managed mutual funds usually have high fees; it's one of the main reasons they fail.

*Useful Apps / Resources

Want to learn more about how to lower your fees and other hidden ways you are charged? We wrote many helpful blog posts about fees and expenses.

Mutual fund companies make it difficult for you to find the fees you pay. They are incented to bury their fees. Fortunately, one of the best ways to find disclosed costs is to head over to Morningstar’s website. At the top of the page, enter the ticker symbol into the "Quote" box, hit enter, then look for "Expenses."

13. Optimize Your 401k

For many people, their 401k is their primary vehicle for retirement. So, you want to be sure you spend the time looking through all the investment options and making the best decisions you can.

*Quick Tips

Be sure you get the company match. Every company is different, but most–if not all–will match your contributions. Ask. Find out what your company’s program is and find out how to maximize it.

Know your fees. Yes, we just recommended this above, but it’s just as important in your 401k. Be sure you choose low cost funds. Many 401k plans offer low-cost index funds, so be sure to carefully evaluate those.

Rebalance your 401k. Some 401k plans have a feature called “automatic rebalancing.” If your plan offers this then sign up. Your 401k will then be automatically rebalanced on a schedule to maintain your target investment allocation. Easy.

*Useful Apps / Resources

Want more expert tips about optimizing your 401k? Book a free call with us today to review your 401k.

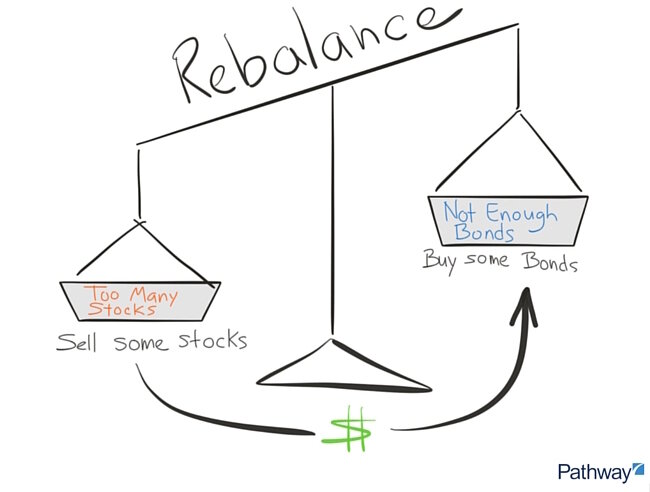

14. Rebalance Your Portfolio

First question. What is rebalancing?

Rebalancing involves making sure that your portfolio stays lined up with your target asset mix. Let's say your target asset mix is 60% stocks, 30% bonds and 10% cash. Once a year you should sell just enough of the funds that grow fastest (lately, stocks)— and add enough to the laggards (cash and bonds)—to restore your target mix. This strategy means you buy low and sell high over time while maintaining the target risk profile for your portfolio.

*Quick Tips

Rebalancing involves making sure that your portfolio stays lined up with your target asset mix. Different asset classes have different risk / reward profiles so you want to make sure your portfolio mix matches your goal and risk profile.

Rebalancing is a fundamental and proven strategy for long-term investing and building wealth.

The golden rule for all investors is to buy low and sell high. If you periodically rebalance, you will automatically follow the golden rule!

*Useful Apps / Resources

Here are some of our articles on portfolio rebalancing.

15. Are You Saving Enough for Retirement?

16. Got Kids? Open a 529 College Savings Plan

Kids + Busy. Right? I know from personal experience. And often saving for college gets pushed far down the To Do list. Don’t fall into this trap. Nearly every 529 plan offers a simple online account opening process. Many accounts can be set up and funded online in less than 10 minutes.

*Quick Tips

Choose low-cost 529 plans that have excellent investment options.

Don’t assume your state is the best (or only) 529 plan you can invest in for your child’s education. Shop around. Look nationwide.

Any 529 plan can be used to pay for qualified education expenses (tuition, room & board, fees, computers, etc) at any accredited college or university.

*Useful Apps / Resources

Here’s a tip from Savingforcollege.com’s founder Joe Hurley from our “12 Expert Tips on Building Wealth” blog post: Even when other financial goals take priority start a 529 account for your child and begin automatic contributions of $25 per month. Your account statements will be a good reminder that college is getting closer and you’ll think about increasing your contributions.

Want to learn more about 529 College Savings Plans. Check out our 529 College Savings blog posts.

17. Manage Your Emotions

Although this is the most “touchy feely” of all our advice, it’s still very important. The ups and downs in the market can cause our emotions to flare up, which tends to cloud our more logical, long-term thinking.

*Quick Tips

Money and investing can stir up powerful emotions, especially during times of market exuberance and it’s inevitable crashes.

Steep market declines can trigger the more primitive parts of our brain, which can lead to panic selling.

Controlling your emotions and behavior can be more important than actual investment knowledge.

*Useful Apps / Resources

Be sure you know some of the common behavioral pitfalls that trip up investors and how to spot them: Mooove Over and Avoid Herd Mentality, How to Avoid Swimming in Sunken Costs, and Signs of the Market Times, Real and Perceived

Still curious? Here are more articles we’ve written on the psychology of investing.

There you have it. 17 powerful, actionable steps you can take today to start building wealth for tomorrow.

Start today and you may be able to retire early or start that business you've already dreamed of sooner than you think!

Want more advice on making the most of your money? Schedule a no-obligation chat with me below.