How to Prepare You and Your Money For a Market Correction

There are few things in investing (and life) that are guaranteed. But the one thing we can count on for sure is that the market won’t stay at the same level. What goes up must come down.

Now, I’m no doomsday prophet, but I do know that history tends to repeat itself and history tells us that from 1900-2016 the markets have experienced a correction about once a year. There are pretty good odds it will happen again.

Are you prepared?

A Lesson On the Markets

Let’s stop for a quick minute and look at some basic market definitions. We hear plenty about market downturns, but that’s not what we’re talking about here. A market correction is when the markets decline at least 10% to adjust for overvaluation (aka when the price of a stock is inflated).

Corrections tend to be short-lived interruptions in the middle of an upward market trend. A downturn, on the other hand, is when the market flips from a bull to a bear and values drop more than 20% for a longer period of time.

Our markets have been going up, up, up lately. No crystal ball exists to tell us when to expect a correction, but the next one could be right around the corner.

Okay. Enough with the financial jargon. What can you do to rest easy when a market correction knocks at your investment portfolio’s door and tries to knock you off your path of building wealth?

1. What Do You Want?

Complacency is never a good place to hang out. A time of change is always a good time to step back and take a second look at what the heck you are doing with your life, financial and otherwise. That’s my inner life coach coming out.

But really, this is as good a time as any to reevaluate your goals. Why are you investing? How much money do you need? (Psst...we have a tool for that). Have you become distracted by short-term noise? Ditch all the digital crap and get one of those old-fashioned index card things. Take that simple 3x5 inch piece of paper and write down the bare bones of your goals and investment strategy. Refocus. It will help when you read a scary headline and you get all the feels (not the good feels). Which leads me to the next checkpoint.

2. Control Those Damn Emotions

You know how strongly I feel about behavior and emotions and the mess they can make of your money (proof is here and here). If you want your finances to thrive, you’ve got to get your emotions in line and rely on all the hard work you’ve done to create a sound investment strategy.

One of my favorite all time investing quotes is from Warren Buffett: “Investing is simple, but not easy.”

There’s a tremendous amount of wisdom embedded in that succinct quote. What the Sage of Omaha is saying is the core tenets of investing are actually pretty simple. But following those time-tested, evidence-based investing rules when the markets head south, well, that’s not so easy because our emotions get in the way.

3. Risky Business

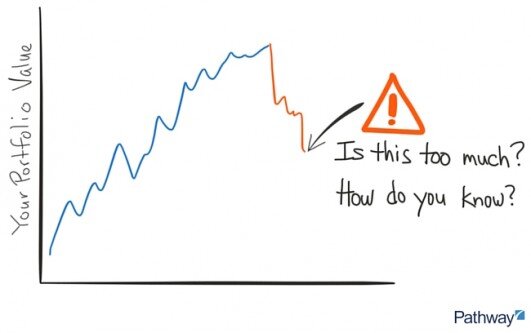

Investing involves risk. The secret is to invest at the risk level that is right for you and your goals. It’s easy to say you want to take risks when the market is up, but risk is no fun when loss becomes a reality.

The eve of a market correction is the perfect time to review your portfolio and make sure you are in the risk sweet spot. And since the market has been at a peak, you might be in need of some rebalancing to get things back in line.

Corrections are normal and healthy, and happen all the time. Even so, they can strike fear in the heart of any investor and threaten to derail even the best laid investment plan. That’s why I do what I do.

Are you nervous about your investments or retirement? Checkout the free guide below: